Request a Quote

Services home

Frontend Development

Backend Development

Database Architecture

Custom API & Middleware

Custom API & Middleware

Custom API & Middleware

Custom API & Middleware

UX Research & Wireframing

UI/UX Design

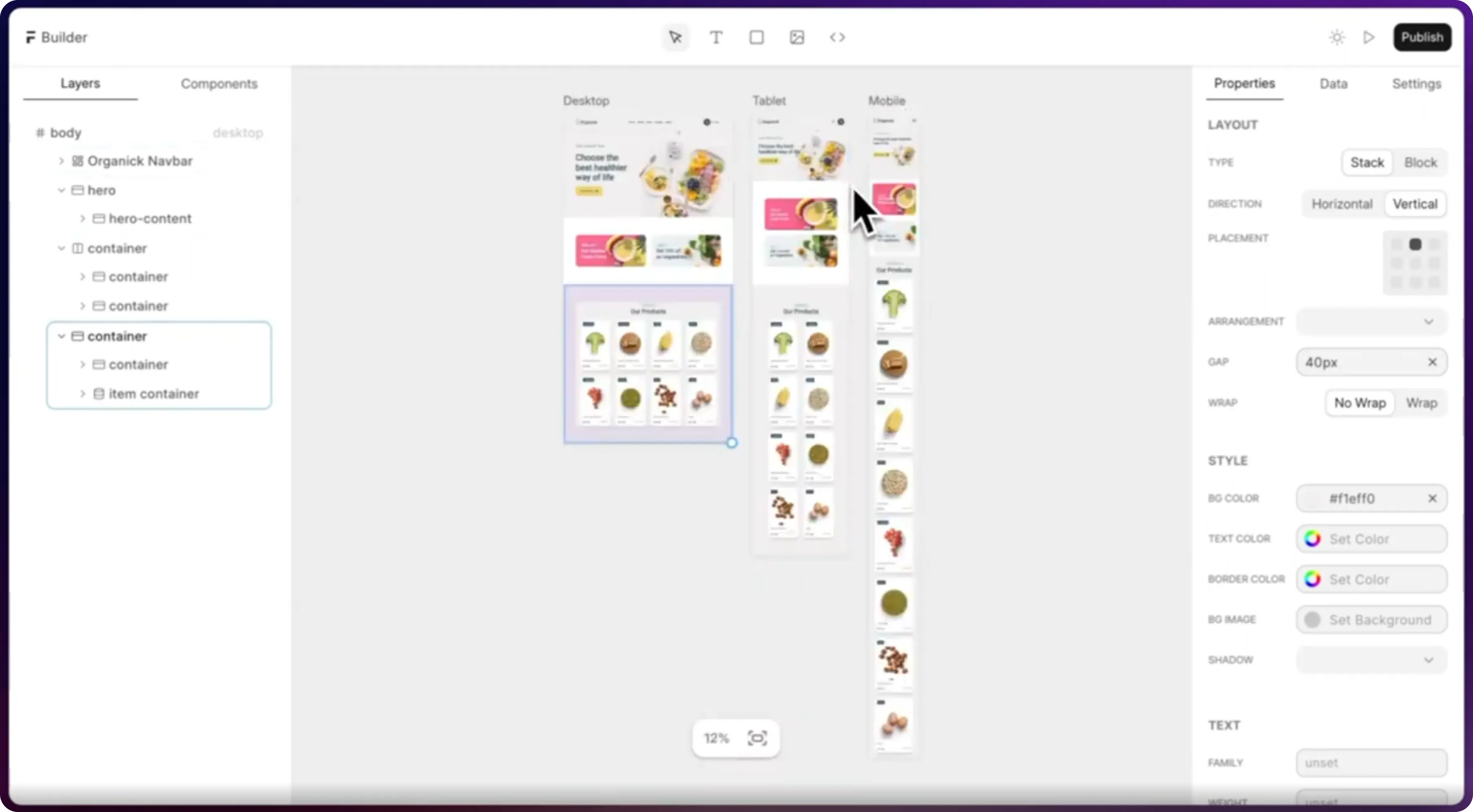

Responsive UI Design

Design System Development

Design System Development

Design System Development

Cloud Deployment

CI/CD Automation

Performance & Backup Management

Performance & Backup Management

Performance & Backup Management

Performance & Backup Management

Custom Frappe App Development

ERPNext Customization & Automation

Frappe Cloud Support & Optimization

FrappeCloud Support & Optimization

FrappeCloud Support & Optimization

FrappeCloud Support & Optimization

Products home

GO1 hR

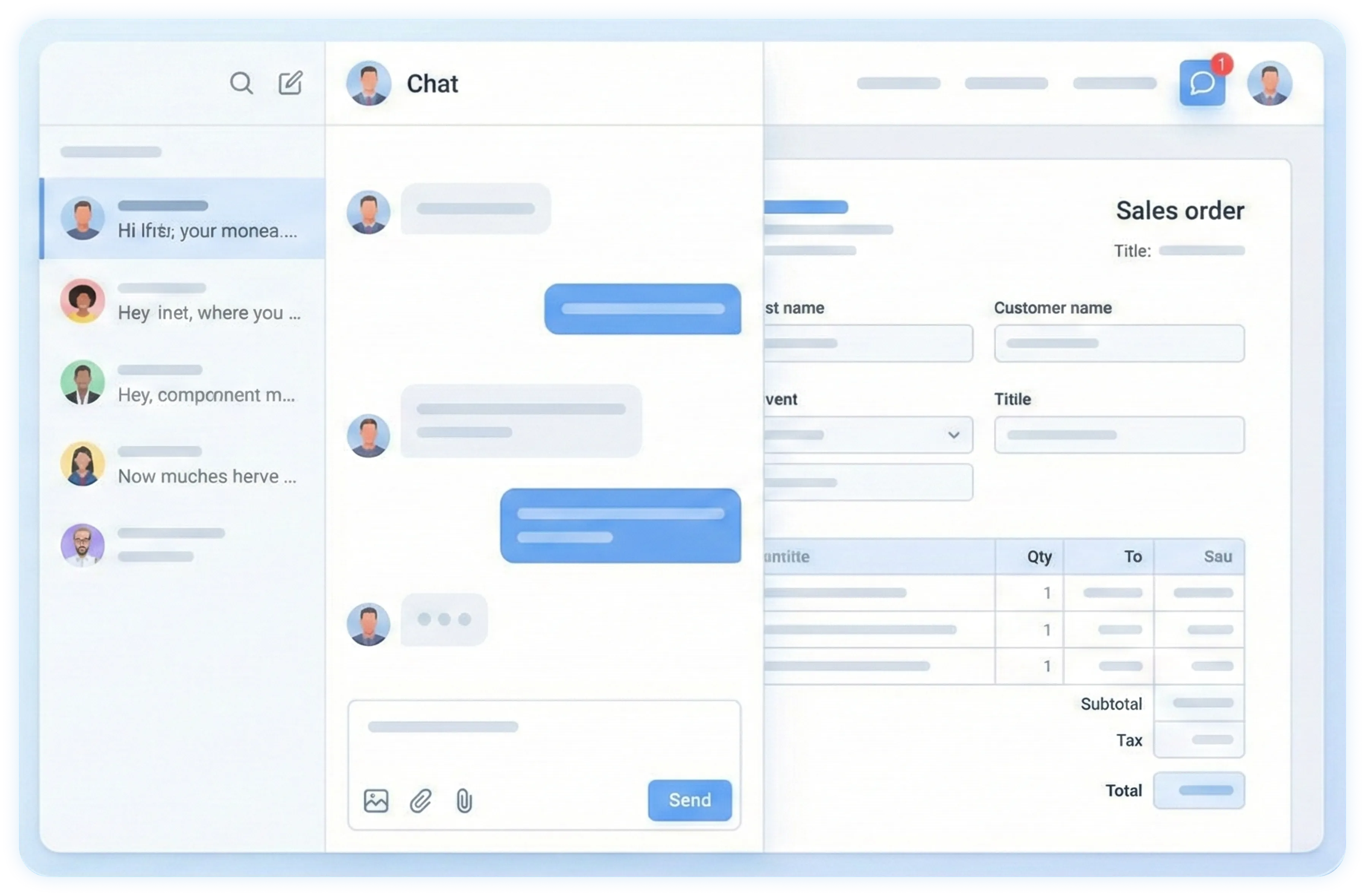

GO1 CRM

gO1 projects

GO1 market

GO1 resto

GO1 commerce

GO1 pulse

GO1 Budget

GO1 vendor portal

GO1 customer portal

GO1 leads

GO1 webshop

GO1 Recruit

GO1 Meet

GO1 enterprise structure

GO1 CMS

Modules

Industries

Accounting

procurement

sales

CRM

Project Management

HR & Payroll

Website & E-commerce

Inventory / Stock

Asset Management

Help Desk

More

hR

CRM

projects

market

resto

commerce

pulse

Budget

vendor portal

customer portal

leads

webshop

Recruit

Meet

enterprise structure

CMS

More

ERPNext Implementation Services

Legacy System Modernization

Business Process Automation

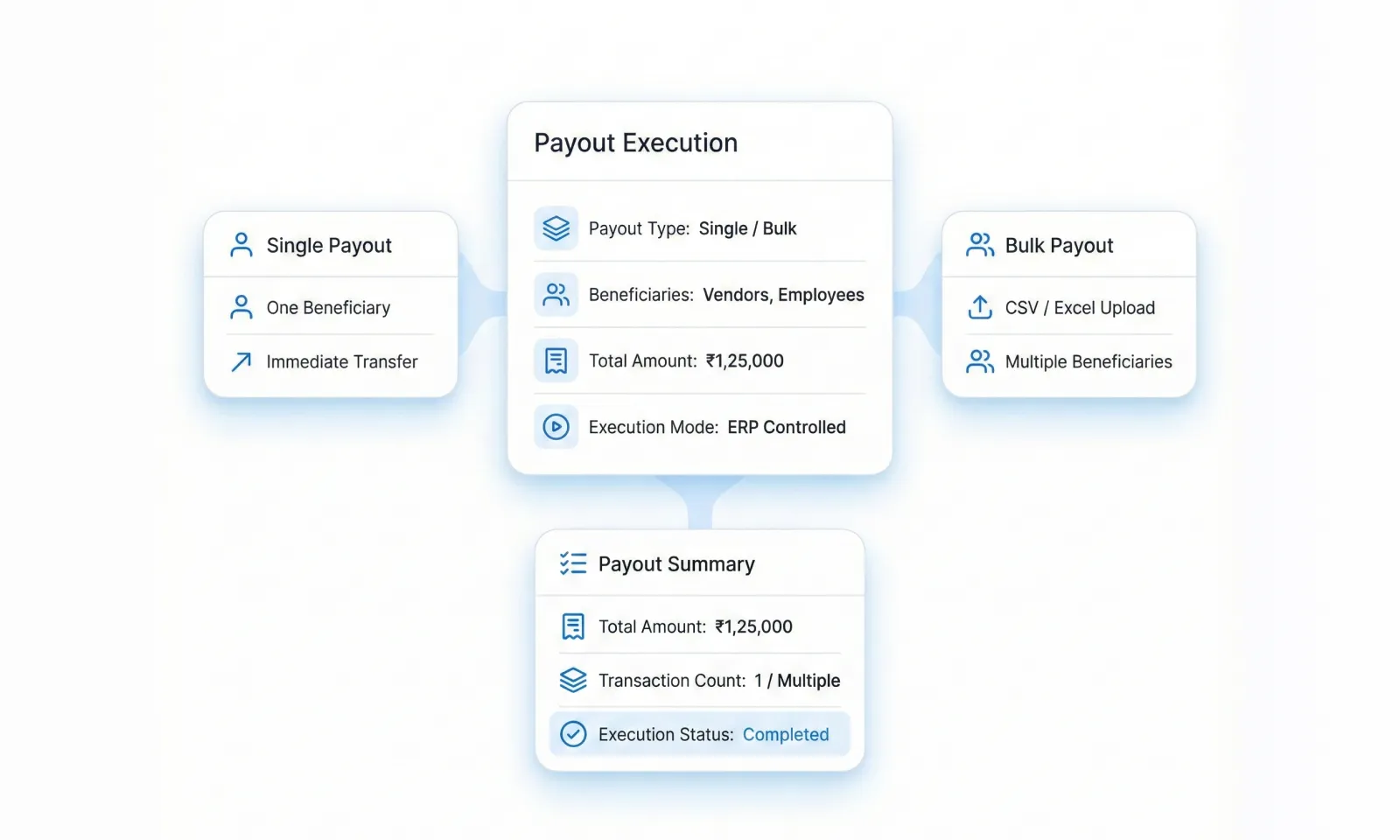

System Integration

System Integration

System Integration

End-to-End Product Development

SaaS Application Development

Startup MVPs

Custom website Development

Startup MVPs

Startup MVPs

Frontend Development

Backend Development

Database Architecture

Custom API & Middleware

Custom API & Middleware

Custom API & Middleware

UX Research & Wireframing

UI/UX Design

Responsive UI Design

Design System Development

Design System Development

Design System Development

Cloud Deployment

CI/CD Automation

Performance & Backup Management

Performance & Backup Management

Performance & Backup Management

Performance & Backup Management

Custom Frappe App Development

ERPNext Customization & Automation

Frappe Cloud Support & Optimization

FrappeCloud Support & Optimization

FrappeCloud Support & Optimization

FrappeCloud Support & Optimization

Hire Remote Developers

Dedicated Teams

Project-Based Delivery

Maintenance & Support

Maintenance & Support

Maintenance & Support

Maintenance & Support

Website Design

Android App

IOS Application

Ipad app design

desktop app design

landing page design

adaptive website design

responsive website design

static website design

uI/UX

E commerce website

CMS

Single page application

web portal

hybrid app development

Progressive web application

custom application

CRM

ERP Software

ERPNext

Cross platform apps

enterprise mobility

More